michigan sales tax exemption rules

In the Kenai Peninsula Borough for example all sellers are REQUIRED to register for sales tax collection emphasis theirs including sellers at temporary events. Sales tax rules for craft fair sellers.

Taxjar Coupon Codes 50 Off Taxjar Com Discount Promo Codes Sales Tax Tax Guide Tax

Municipal governments in Arkansas are also allowed to collect a local-option sales tax that ranges from 0 to 6125 across the state with an average local tax of 2627 for a total of 9127 when combined with the state sales tax.

. Although theres no state sales tax in Alaska many municipalities have a local sales tax and policies vary by locality. Iowas tax rules regarding the taxation of shipping is relatively straight forward. Municipal governments in Wisconsin are also allowed to collect a local-option sales tax that ranges from 0 to 175 across the state with an average local tax of 0481 for a total of 5481 when combined with the state sales tax.

Municipal governments in Kansas are also allowed to collect a local-option sales tax that ranges from 0 to 5 across the state with an average local tax of 1987 for a total of 8487 when combined with the state sales tax. The maximum local tax rate allowed by Wisconsin law is. If you sell grocery items online the TaxJar API has your back.

CityLocalCounty Sales Tax - Michigan has no city local or county sales tax. If shipping is stated separately on the bill as its own line item it is not taxable. All claims are subject to audit.

Assessing Officers Report for Industrial Facility Exemption Certificates 2008 and After. For use with 45 or fewer certificates. Its goal is to make it easier for businesses to pay state sales tax by covering the.

States have varying rules about how such tax free purchases must be made. Notice of New Sales Tax Requirements for Out-of-State Sellers For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the General Sales Tax Act MCL 20552b and Use Tax Act. If you are purchasing goods that you intend to resell you can make purchases from your suppliers tax-free by acquiring the appropriate Sales Tax Exemption Certificate for your state.

Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualified transactions. The Louisiana sales tax exemption for manufacturing provides an incentive for manufacturing production in Louisiana by allowing manufacturers to purchase manufacturing machinery and equipment tax exempt La. Diplomatic Sales Tax Exemption Cards The Departments Office of Foreign Missions OFM issues diplomatic tax exemption cards to eligible foreign missions and their accredited members and dependents on the basis of international law and reciprocity.

Step 4 Indicate the reason for sales tax exemption. In the state of Arkansas sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Retailers - Retailers make sales to the final consumer.

Michigan Sales and Use Tax Certificate of Exemption. Arkansas has very simple rules when it comes to taxes on shipping. Streamlined Sales and Use Tax Project.

Appendix 2 1993. The maximum local tax rate allowed by Arkansas law is 55. Appendix 1 ISD Specific Tax Percentages 2014-2021.

If a retailer is purchasing merchandise for resale check box number 2 and include their Sales Tax License Number. Collecting Sales Tax on Grocery Items. Do I need to register.

Tax Exemption Certificate for Donated Motor Vehicle. The sales tax license and exemption certificate are commonly thought of as the same thing but they are actually two separate documents. Industrial Facility Tax Voucher.

The Streamlined Sales and Use Tax Agreement was established in 1999 as a cooperative effort between state and local governments and the business community. I want to sell my product at one show in Michigan and I dont have a Michigan sales tax license. 2020 Aviation Fuel Informational Report - - Sales and Use Tax.

Sales tax of 6 on their retail. In the state of Connecticut sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Email the IFE.

Michigan Sales and Use Tax Certificate of Exemption Fillable Form 3372. Step 5 Fill out the name of the business address phone number signature title and date. If you will be doing 2 or less shows a year intermittently file Form 5089 Concessionaires Sales Tax Return and Payment.

An application for a sales tax license may be obtained on our web site. Essentially if the item being shipped is considered to be taxable in Arkansas then the shipping is seen as being taxable as well. Arkansas has a statewide sales tax rate of 65 which has been in place since 1935.

Electronic Funds Transfer EFT Account Update. If you will be selling your product every year consecutively create a MTO profile and register your business through e-Registration to. Louisiana defines machinery and equipment as tangible personal property or other property that is.

The state sales tax rate is 6. It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. ISD Prelim Appendix 1 Calculations.

Instructions for completing Michigan Sales and Use Tax Certicate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualied transactions. In most states the sales tax is designed to be paid by the end-consumer of taxable goods or services. Kansas has a statewide sales tax rate of 65 which has been in place since 1937.

Several examples of exceptions to this tax are certain types of safety gear some groceries certain types of clothing childrens car seats childrens bicycle helmets college textbooks compact fluorescent. All claims are subject to audit. Are shipping handling subject to sales tax in Iowa.

If audited the Indiana Department of Revenue requires the seller to have a correctly filled out ST-105 Sales Tax Exemption Certificate. A value-added tax VAT known in some countries as a goods and services tax GST is a type of tax that is assessed incrementally. It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed.

Just use product code 40030 to indicate grocery items and well ensure you collect the right amount of sales tax on all of the grocery items you sell no matter if the groceries are taxable tax exempt or taxed at a reduced rate. Michigan Sales and Use Tax Contractor Eligibility Statement. Industrial Facility Tax Report-Short Version.

However if shipping is included in the price of. In order to register for sales tax please follow the application process. Sales Tax Return for Special Events.

If the ultimate consumer is a business that collects and pays to the government VAT on its products or services it can reclaim the tax paid. Filling out the Indiana Sales Tax Exemption Certificate Form ST-105 is pretty straightforward but is critical for the seller to gather all the information. These cards facilitate the United States in honoring its host country obligations under the Vienna Convention on Diplomatic.

The maximum local tax rate allowed by Kansas law is 4. The sales tax license allows a business to sell and collect sales tax from taxable products and services in the state while the exemption certificate allows the retailer to make tax-exempt purchases for products they. It is levied on the price of a product or service at each stage of production distribution or sale to the end consumer.

Wisconsin has a statewide sales tax rate of 5 which has been in place since 1961.

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

Michigan Sales Tax Small Business Guide Truic

Sales Tax Challenges For Manufacturers Distributors

Michigan Sales Tax Guide For Businesses

Michigan Sales Tax Guide For Businesses

Michigan Sales Tax Guide For Businesses

Michigan Sales Tax Exemptions Agile Consulting Group

Sales Tax On Grocery Items Taxjar

Michigan Safety Equipment Exempt From Sales And Use Tax Doeren Mayhew Cpas

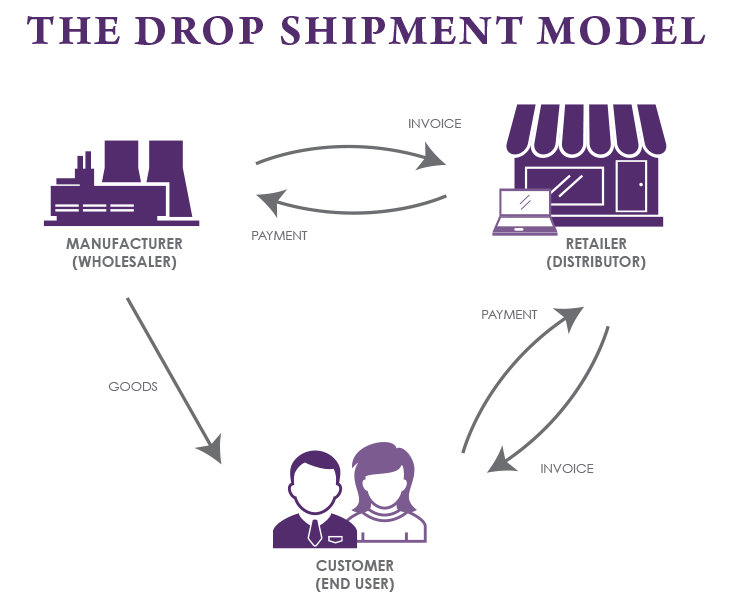

How Do Drop Shipments Work For Sales Tax Purposes Sales Tax Institute

Sales Tax Goes Live For Florida Michigan Tennessee Kansas And Missouri Runsignup Blog

Michigan Sales Tax Exemptions Agile Consulting Group

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com